Show Me the MONEY!

In the previous entries of this series, we talked about some fundamental Small Business money issues:

Ok – so we’ve covered the basics, and laid down a pretty good foundation for dealing with important Small Business financial issues and, hopefully, getting past those doubts and inhibitions which make it difficult to “ask for the money”. Now, we move on to the fun part: Let’s Get PAID!

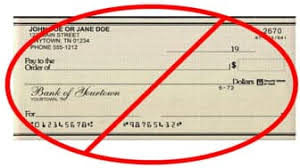

No Checks. PERIOD!

It’s 2017, and the year is almost over. We’re well past the point of accepting personal checks for payment. Constantly checking the mailbox or having to take a trip to collect a piece of paper which then has to be depositing in a bank, then waiting several days to finally get paid – or get stiffed with a bounced check – is simply ridiculous.

Stop letting your customers determine how and when – and IF – you get paid. Everybody has at least a debit card – nobody books an airline flight, reserves a hotel or rents a car with a check or cash. Anyone who does not have plastic simply isn’t your customer. End of story; move on. You not only get to choose who your customers are; you, and you ONLY, determine how you will receive payment. This point is not negotiable. You’re not in business for anyone’s convenience – you’re doing business to make a profit… which cannot happen until you get paid, and get paid as quickly as possible.

Stop letting your customers determine how and when – and IF – you get paid. Everybody has at least a debit card – nobody books an airline flight, reserves a hotel or rents a car with a check or cash. Anyone who does not have plastic simply isn’t your customer. End of story; move on. You not only get to choose who your customers are; you, and you ONLY, determine how you will receive payment. This point is not negotiable. You’re not in business for anyone’s convenience – you’re doing business to make a profit… which cannot happen until you get paid, and get paid as quickly as possible.

No Cash, either

You’re a BUSINESS, not a *hobbyist*. Off the books is off the grid: you can’t build net worth or credit worthiness with unclaimed, untraceable financial transactions. Also, electronic payments automatically record and categorize each transaction, which among other advantages is an incredible time saver come tax season.

And for those of you who think you’re “getting over on the Uncle Sam“, or somehow operating “smarter” if you hide income from the government, consider this: your business is only worth what is shown on the record. Why does this matter? Try going to a bank for a business loan, or a line of credit, when you’ve been hidden 30 – 40% of your revenue. What you’ve done is made yourself only 60 – 70% as credit-worthy as you could have been.

On the record

Don’t write a book, but DO give a detailed account of what the invoice is for. Memories are slippery, especially when it comes to money. The more you remind them of why they agreed to engage your services (remember: they are NOT HIRING YOU!), the more easily they will pony up the cash… electronically, of course.

Your (signed) written agreement and your detailed invoice are the bookends of your work record. Many Small Businesses, especially service-based ones, exist for years with no history or audit trail of what they’ve actually done during the time they’ve existed. Have you just been grinding out work, or have you actually accomplished anything? If you’re looking for partners, or seeking investment from non-traditional financing like venture capitalists, “angel investors” or family and friends, they’ll want to look at more than just your bank balance.

It not just how much you’ve made – it’s HOW you made it. That’s important even if it’s just for tracking your progress… or determining if there’s been any progress at all. And it’s always simply nice to be able to look back over a month, a quarter or a year and see what you’ve done; memory fades quickly, as you’re always focusing on the task at hand, the next task, the next client.

An Invoice is NOT A BILL

A detailed invoice is a request for payment for SERVICES RENDERED. They’re not lending you money: they’re paying you for the work you’ve ALREADY DONE.

It’s also a service record – the profitable activity performed by your business. Much of what you do “as a business” is behind the scenes. You are preparing to do the work, gathering the skills and materiel required to perform the work and getting to and from the work (even if it’s just a trip from your bedroom to your workspace at home). NOE of this is what your customers and clients are paying you for… they don’t even really pay you for the actions and effort which directly contributes to “work being done”.

It’s also a service record – the profitable activity performed by your business. Much of what you do “as a business” is behind the scenes. You are preparing to do the work, gathering the skills and materiel required to perform the work and getting to and from the work (even if it’s just a trip from your bedroom to your workspace at home). NOE of this is what your customers and clients are paying you for… they don’t even really pay you for the actions and effort which directly contributes to “work being done”.

They pay you for the RESULTS. As my first business coach always says “Remember that everyone’s favorite radio station is money has a short shelf life – so does the memory of a satisfied customer. The more time that passes between the end of the job and the payment of the invoice, the more likely even the most satisfied customer will be to question what their paying for, and why.

So when we advise you to submit a detailed invoice, we mean detailed in terms of the RESULTS DELIVERED, not a punch list of what it took to get the work done. In other words, it’s not “what you did“, it’s “what you did FOR THEM“. Nobody cares how hard you worked, but how well – your invoice details should make them think “oh yeah: THAT’S why I hired them”.

That’s the reason that seasoned project managers and contract professionals talk about “deliverables” and not “outcomes”: it’s got to be from the customer’s perspective. They don’t want to know how you did it, although this may be quite important to you. This is a mistake I made at the beginning of my consultancy. I felt it was important to show that I had “worked real hard“, as if I had to impress them. To be honest, I think I also wanted to impress upon them how complicated this IT stuff was, as if to prove I was worth my fee.

NOBODY CARED. It didn’t stop me from getting paid (thankfully), but I found that when I began to put things in terms of results and not effort, not only did the invoices get paid faster and with less pushback, but I would sometimes get feedback about this or that detail, either requests for clarification or positive comments like “oh, you did that TOO?“

Not “good for you; lookit how hard you worked”, but “gee thanks – you did more (for US) than we even thought we’d asked for“. THAT’S the result that matters most to YOU; a satisfied customer. They’re the ones most likely to work with you again, and to make unsolicited referrals because they’re just that happy with the work.

Always say “Thank You”

This is something nobody mentions in Small Business financial discussion: the importance of gratitude. It’s also the flip side of “avoid the bad customers” – REWARD the good ones.

Just as you don’t have to work with the bad customers, the good customers don’t have to work with you. They choose to. ALWAYS let them know that you understand this, and that you appreciate it. Not just in conversation, but on your invoices. EVERY time.

Just as you don’t have to work with the bad customers, the good customers don’t have to work with you. They choose to. ALWAYS let them know that you understand this, and that you appreciate it. Not just in conversation, but on your invoices. EVERY time.

I use the “notes” section of my invoices for this purpose. I say something to the effect of “Thank you for the opportunity of providing quality service for you and your business”. It seems like a small thing, and nobody’s going to refuse payment because it isn’t there. Also, nobody has ever mentioned this in the hundreds of invoices I’ve submitted and had paid in the nearly ten years I’ve been working for myself.

That’s not the point. Just as you shouldn’t do charitable things to bring praise or attention to yourself, don’t express your gratitude seeking an “attaboy” or a pat on the head. Do it because it’s part of the sales conversation. They may not ever say anything, but they WILL notice it. And, subconsciously perhaps, they’ll notice that you’re the only one who says it, explicitly, every time.

You show them you don’t take them for granted, that they’re not just a cash machine for your personal benefit. When it comes to deciding to engage your services again – or choosing between you and a competitor trying to win them on price or other benefits – it may be the subtle difference that tips the balance in your favor.

You may never know… do it anyway. Because that’s the way YOU do business. Because, at the end of the day, that’s the person you are. And that, after all, is what really matters.